“We have 3 lakh appeals pending and the amount involved is Rs. 5.5 lakh crore wherein people’s fate are hanging. In order to remove all these disputes, we have come out with a resolution scheme and we do hope in many cases the assessee will prefer to settle the case,” he said while addressing the CII National Council meeting.

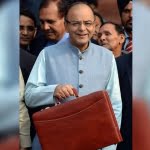

Finance Minister Arun Jaitley in the Union Budget has proposed a ‘dispute resolution mechanism’ under which a taxpayer who has an appeal pending before the Commissioner (Appeals) can settle his/her case by paying the disputed tax and interest up to the date of assessment.

No penalty in respect of income tax cases with disputed tax up to Rs. 10 lakh will be levied. Cases with disputed tax exceeding Rs. 10 lakh will be subjected to only 25 per cent of the minimum of the imposable penalty for both direct and indirect taxes.

Mr Adhia said the reason for a tax payer to go into appeal is not the assessment amount, but the 300 per cent penalty and he wants to contest the penalty.

“I’m sure this scheme will work. A lot of people will come forward to take benefit of this,” he said.

As regards the Budget proposal to lower corporate tax for new manufacturing units to 25 per cent, Mr Adhia said the step would promote Make In India.

“This is our way of inviting foreign investment to our country. If you are foreign company wanting to set up manufacturing unit you are welcome we will charge only 25 per cent. This is the best option available,” Mr Adhia added.